Redefining Property Investment

Our technology connects certified investors with UK property developers and asset managers.

Our technology connects certified investors with UK property developers and asset managers.

We give you simple and secure tools to assess, invest and manage.

We give you simple and secure tools to assess, invest and manage.

Brickowner enables high net-worth and sophisticated investors to access professionally managed property investments and the opportunity to buy and sell throughout an investment’s term on the secondary market.

Now you can harness the power of our technology to seamlessly manage your investors whilst efficiently meeting your capital requirements.

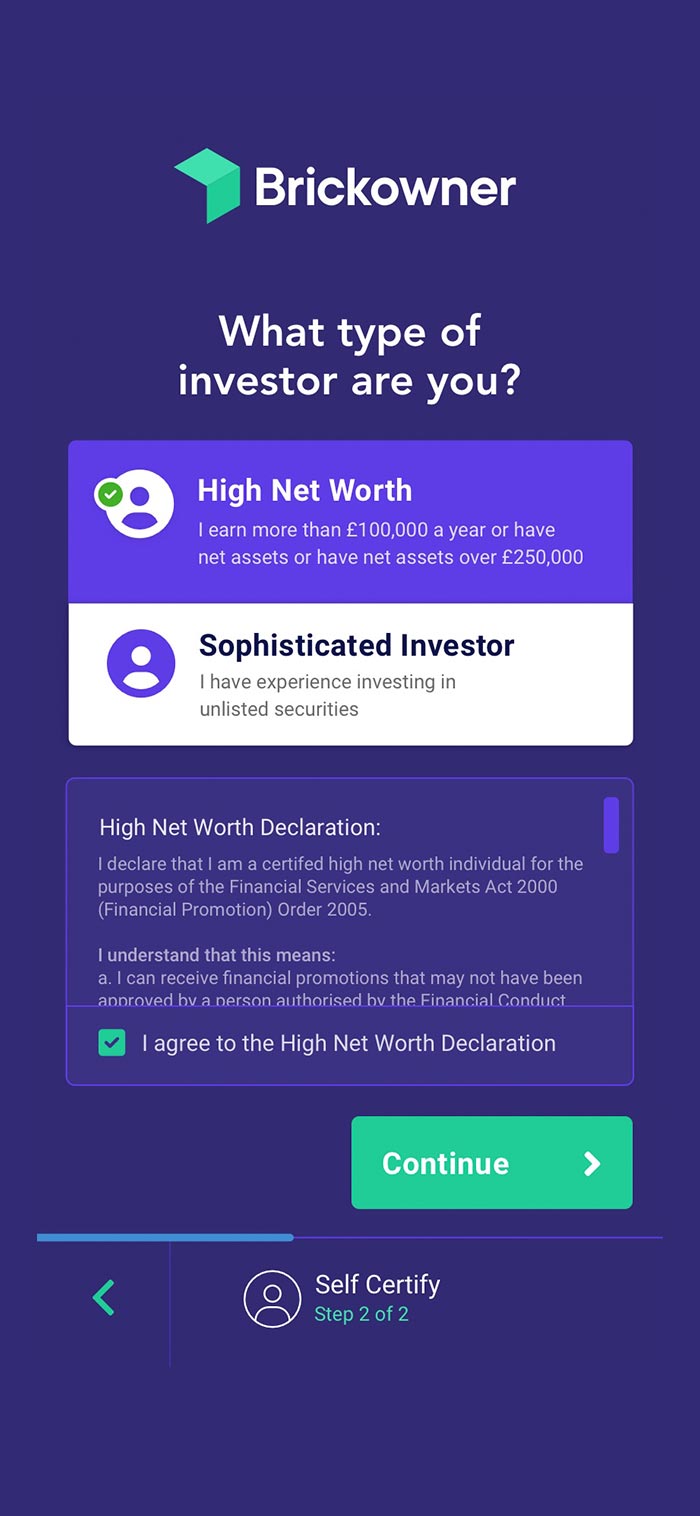

It takes minutes to create a Brickowner account. Due to the nature of each investment, these opportunities are only available to certain types of investors. You will need to self certify confirming that you fall into one of the required categories.

Once you have completed the sign up process and self-certified through our platform you will be able to access our open investment campaigns.

Investment opportunities range from portfolios, developments, multiple projects and property-backed lending portfolios. You can access webinars and information about the campaigns through our platform and ask questions.

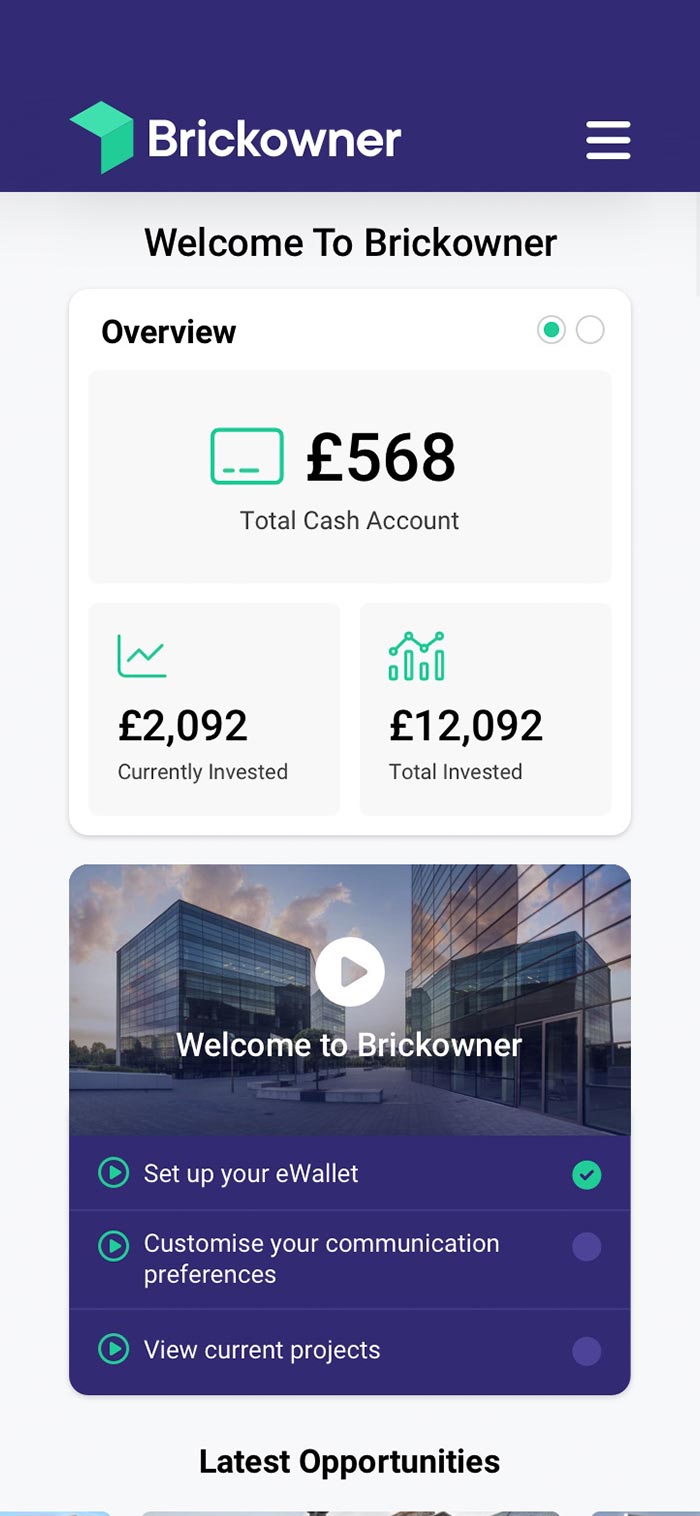

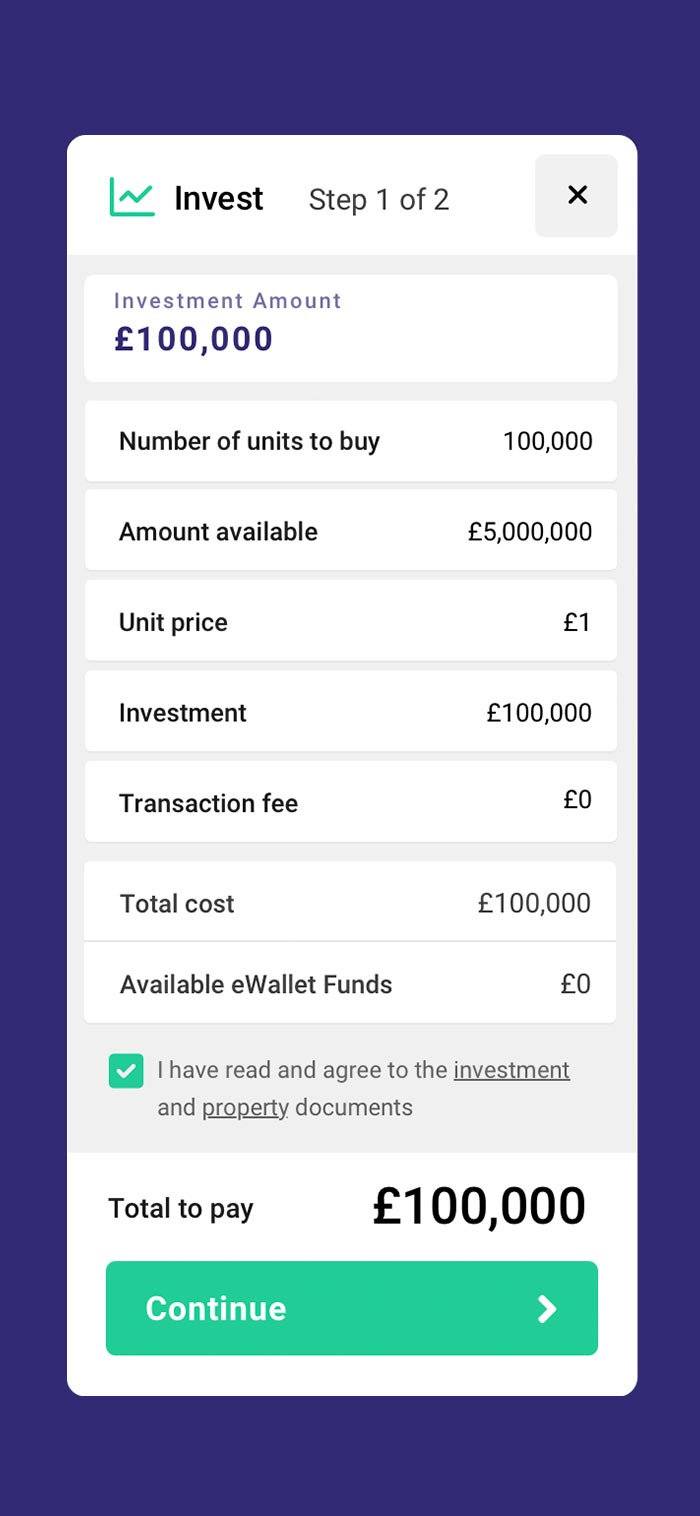

To begin investing, you first of all need to add funds to your online wallet, which is provided through our payment provider, MangoPay. Once you have done this, you can allocate funds to your chosen investment.

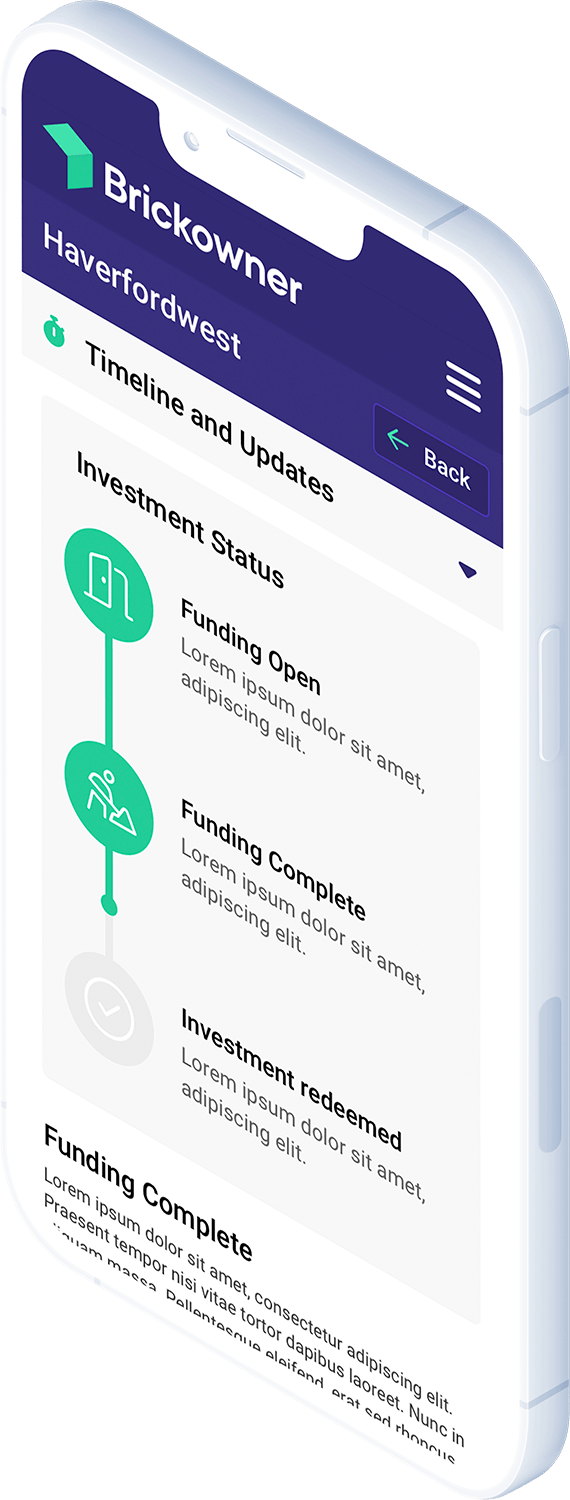

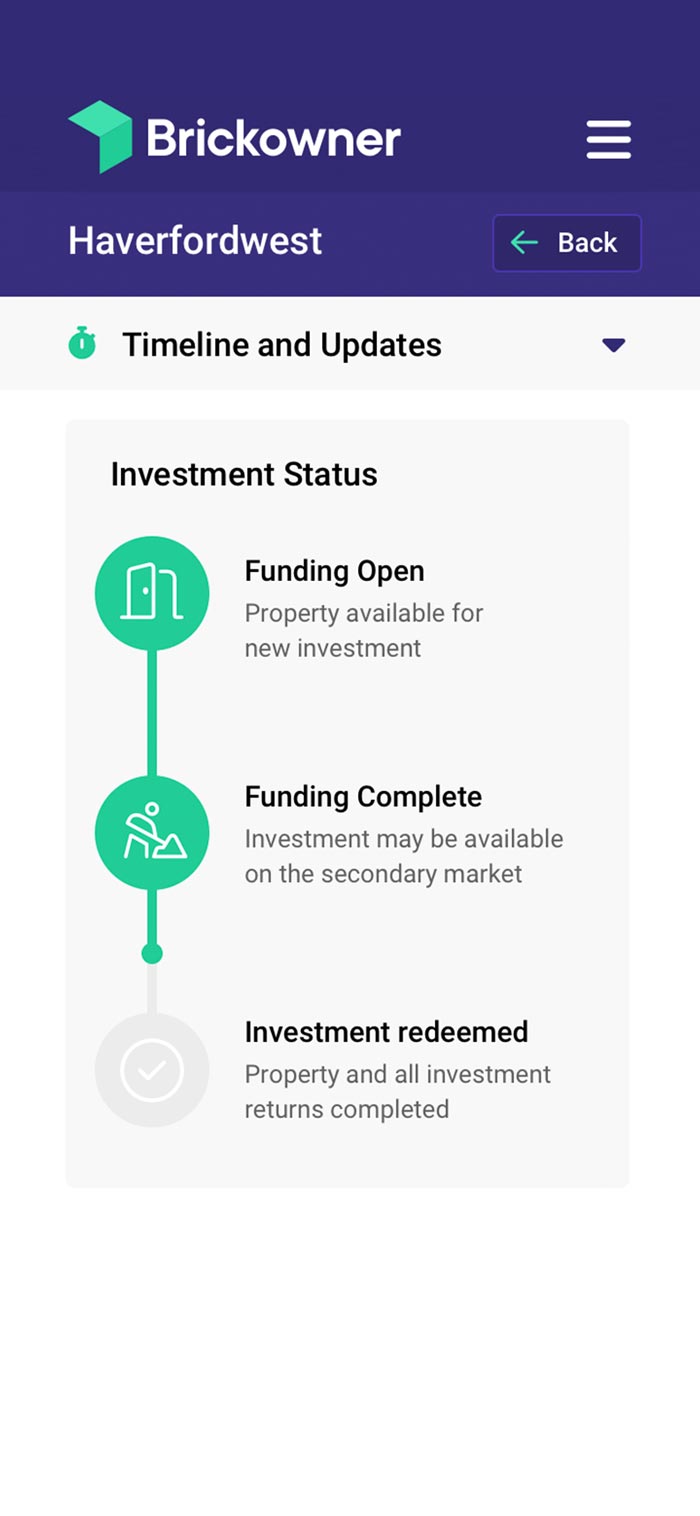

Once the total funding target has been met for your chosen investment, the investment will go live and you will begin to be updated on the project or portfolio through your dashboard.

Throughout your investment term, you have the option to use the secondary market to offer your investment for sale to the Brickowner investor community. You also have the opportunity to top up your investments through the secondary market.

On completion, any returns will be paid to investors although, please note, investments can go down as well as up and returns are not guaranteed. Investors will have access to their full investment history and the opportunity to invest into similar projects.

A professionally managed Student Housing complex in Cheshire

This investment funded the purchase and development of a mixed-use building into an HMO

Access to an existing portfolio of asset backed property loans

Our goal is to make investing in professionally managed property opportunities accessible, approachable and seamless. We achieve this by combining our industry knowledge, network and technology.

Access professionally managed property investments from £500

Ability to buy and sell existing Brickowner investments through our secondary market

Our team follows a stringent due diligence process to vet each opportunity

Secure and seamless technology, a little more text here would be useful to even descriptions

Exclusive events and newsletters, a little more text here would be useful to even descriptions

Secure and seamless technology, a little more text here would be useful to even descriptions

Opportunity to diversify your portfolio, a little more text here would be useful to even descriptions

Our goal is to make investing into professionally managed property investments approachable and seamless

Your investments are ring-fenced and separated from the assets and liabilities of Brickowner Limited. Each property investment is made via a UK limited company that is distinct from Brickowner Limited.

We are much more than a property crowdfunding platform that simply acts as a conduit for investing. Brickowner is a service, that aims to monitor the investments on our investors’ behalf and keep them updated at each step.

Investment opportunities range across commercial and residential property. We offer opportunities to invest in senior and mezzanine lending and equity opportunities

Our dedicated investment team are on hand to answer any of your questions

Estimated reading time: 2 min

Due to the potential for losses, the Financial Conduct Authority (FCA) considers this investment to be high risk.

• It is common for property funds to lose money over time.

• The business offering this investment is not regulated by the FCA. Protection from the Financial Services Compensation Scheme (FSCS) only considers claims against failed regulated firms. Learn more about FSCS protection here.

• The Financial Ombudsman Service (FOS) will not be able to consider complaints related to this firm. Learn more about FOS protection here.

• Even if the fund you invest in is successful, it may take several years to get your money back. You are unlikely to be able to sell your investment early.

• Putting all your money into a single business or type of investment for example, is risky. Spreading your money across different investments makes you less dependent on any one to do well.

• A good rule of thumb is not to invest more than 10% of your money in high-risk investments. Learn more here.

• The percentage of the business that you own will decrease if the business issues more shares. This could mean that the value of your investment reduces, depending on how much the business grows. The fund is likely to issue multiple rounds of shares.

• These new shares could have additional rights that your shares don't have, such as the right to receive a fixed dividend, which could further reduce your chances of getting a return on your investment.

If you are interested in learning more about how to protect yourself, visit the FCA's website here.

The material on the website is intended exclusively for high net worth investors, sophisticated investors and investment professionals. Only these categories of investor will be permitted to participate in the investment opportunities available on the website. A high net worth investor includes an individual with an annual income of at least £100,000 or net assets (excluding principal residence and pensions) of £250,000. A sophisticated investor includes an individual with relevant previous experience in unlisted investments. For more detailed information about the eligibility criteria, please see here. The content of the website is exempt from the general restriction on unauthorised firms communicating financial promotions. If you are unsure about your categorisation or about investing in unlisted property funds, please consult an appropriately qualified independent financial advisor.